Heat-as-a-Service: a shortcut through the complexity

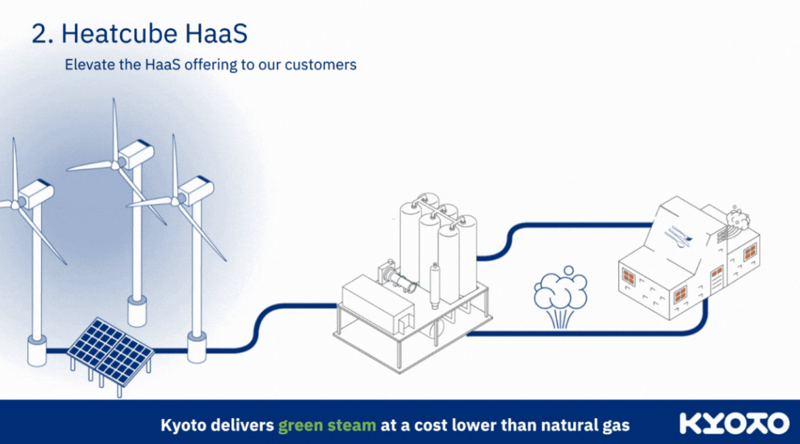

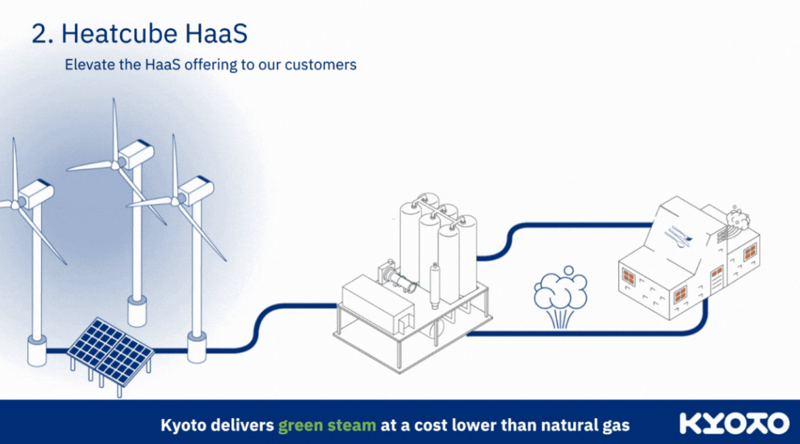

Instead of investing millions in new heat infrastructure, what if you could simply lease your heat?

Pay only for what you use without taking on technology or market risks? Or as Tim de Haas puts it: “Companies don’t make their own water. They buy it. So why shouldn’t they buy the heat they need for production?”

That’s the idea behind Heat-as-a-Service: eliminating both the financial and technological roadblocks to decarbonization.

– For the vast majority of industries, Heat-as-a-Service removes the remaining uncertainty they have when it comes to decarbonization, Tim says.

With Kyoto Group’s Heatcube delivered as a service, you can switch to clean heat without major capital investment — while gaining price stability and supply security. And because Heatcube is a thermal battery, it can also act as a flexible asset that supports the grid — absorbing electricity when it’s abundant and supplying heat when it’s needed.

In Hungary, KALL Ingredients is the first company to adopt the model.

With Heatcube, KALL Ingredients receives heat on demand at a lower cost than fossil fuels without financial or technical risk. Tim sees KALL Ingredients as a prime example of a company choosing action over delay.

– Companies like KALL Ingredients want to see real change on-site, they’re not interested in green certificates. They want it to be tangible. They want to see the ‘electrification of heat’ truly happening.

What’s holding companies back and why the clock is ticking

For decades, industrial heat was simple: fossil fuels in, steam out.

That era is ending. Regulations are tightening. CO₂ taxes are climbing. Financing for fossil-reliant operations is drying up. And customers now demand credible low-carbon supply chains.

And here’s the catch:

More than 44,000 industrial sites across Europe will need to transition to clean heat in the next 10–15 years. And only a handful of providers can deliver those solutions at scale.

– Change isn’t coming, it’s already here, says Tim de Haas. – And even if the intention to decarbonize is clear, the next step often isn’t.

In Tim de Haas words, we’re seeing a classic supply-and-demand issue unfolding.

– Companies that act now are going to be rewarded by having a solution in place while others are scrambling for options. They’ll secure the best technologies, pricing and delivery. Those who wait will face rising costs and fewer options. Many might need to resort to sub-par alternatives, or costly temporary solutions. That’s why I say the change is already happening, he says, adding:

- The real question is whether you’re prepared for it. Some assume they can wait for the right moment, but the truth is, by the time they decide, they’ll be at the back of a very long queue.

And the pressure isn’t just about technology access. It’s coming from every direction:

- Regulations & CO₂ taxes – Carbon pricing is rising steadily, making fossil-based heat more expensive year by year.

- Volatile energy costs – Budgeting becomes harder as natural gas prices fluctuate and maintenance costs grow.

- Financial institutions – Banks and investors are moving away from fossil-heavy industries, making financing harder to secure.

- Customer demand – Industrial buyers are no longer just asking for greener products — they expect real progress on decarbonizing the supply chain, their scope 3.

Proper risk management helps tackle these issues, and ultimately leads to the need to take positive action. Still, Tim de Haas understands why many companies hesitate.

- Yes, it’s simultaneously a big financial investment and a technological risk. It’s not like there are thousands of sites you can visit to see how the new technology works, Tim de Haas says, adding:

- But the upside is undeniable, both financially and reputationally.